Unprecedented times

So we find ourselves in an interesting time where businesses are shut, most of us are trying to work from home, and we're uniting together as a community to stop the spread of Covid-19 and protect those most vulnerable throughout New Zealand.

This Level 4 situation where only essential services can be operating means a lot of financial pressure on businesses, individuals and the economy in general. Thankfully we have a government in New Zealand who are aware of this and are doing everything they can to keep the country from going into a deep financial depression. As of March 24th, the government announced that they are working with the main retail banks to secure mortgage repayment holidays or interest only mortgage repayments throughout this crisis.

What does this mean for me?

Right now, no one is 100% sure! Everyone is waiting to get specifics from each of the banks. We're waiting to know:

- What are the criteria?

- How long these terms will be for?

- What proof of loss of income is needed?

- What the terms are for when repayments do start again?

- And much more.

What do we know?

The banks already have a precedent for this as they all have financial hardship departments and policies. However, this is a significantly different situation with much larger implications.

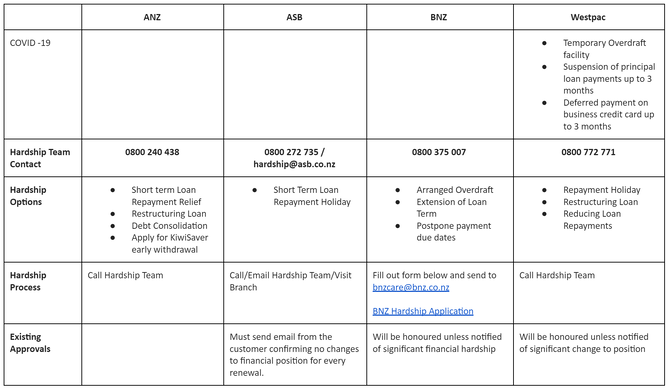

Here is a table of the banks current financial hardship policies with what we know already about their Covid-19 policy. We will update this as we get more information.

What should you do now?

There are a few steps to take right now to make sure you have the information and you are on the front foot with your mortgage.

- If you want to stay up to date from us with the latest information, email office@mymortgage.co.nz and we'll let you know when any new policies are added or we have more information.

- Contact us and/or your bank early so that we can start processes for you before things get too serious for you.

- Chat to us about the implications of the options available. This isn't a "free ride" from the banks. The term of your loan may be extended or the interest over the period added to your loan so you'll need to consider this.

- Plan for when things get back to "normal" and what you are going to do with your mortgage. We can discuss this with you and put a plan in place for you.

What's most important?

Right now the most important thing is to keep our families and wider communities safe. The government has said that no one will loose their home because of the Covid-19 lockdown so there is help even if things are tight for you.

We're here to help and can jump on a phone call or video call to discuss your options and point you in the right direction. Contact us and we'll be happy to talk and work through things with you.