Come meet the My Mortgage Team at Fieldays!

Are you looking to buy your First Home, or would like a plan to get there?

If you’re working in a rural business, earning a salary or wages, and want to know more about the home buying process, come and catch up with Claire & Adam at Fieldays!

We know rural, we know mortgages and also make the process more fun and less boring, too.

Why we love rural professionals

You’re the backbone of our agricultural industry, providing essential support and trusted advice to farmers and growers. You help farmers manage their businesses, navigate challenges, and seize opportunities.

We know how awesome you are and want to share our knowledge to give you the financial knowledge and tools you need to succeed.

Why swing by to see us at Fieldays?

Personalised Advice & Experience: We’ve got personalised mortgage advice to help you make the best financial decisions.

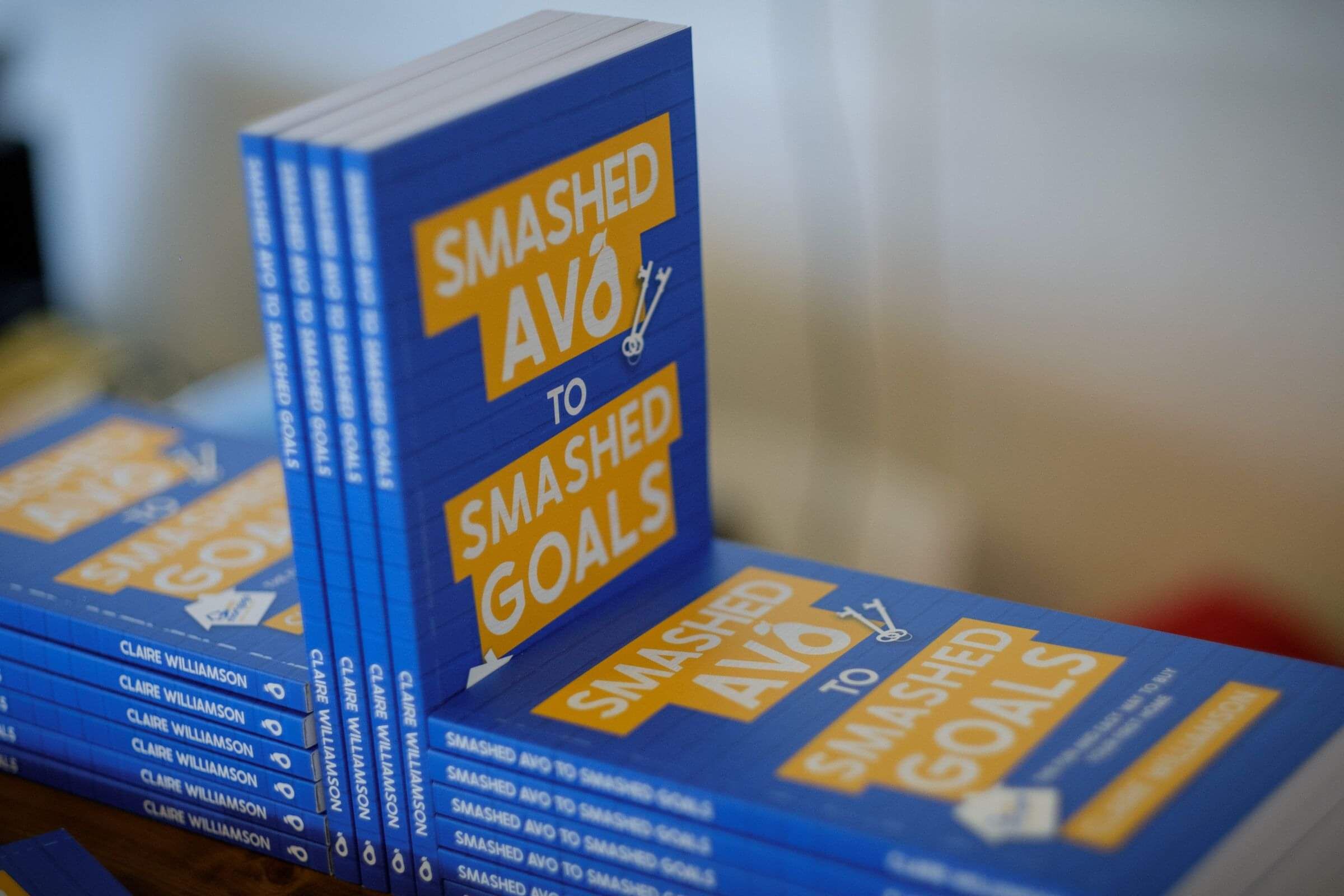

First Home Buyer Help: Buying your first home can be a bit overwhelming. We’re here to guide you through every step of the mortgage process. Plus, you can grab a copy of Claire’s book, “Smashed Avo to Smashed Goals”.

Community Focused: We’re all about supporting and empowering rural professionals and giving back to our people. It’s not just about business for us – it’s about building relationships and growing our community.

How My Mortgage can help you...

We know our stuff: We’re committed to giving you the knowledge and tools you need to succeed. We’ll help you navigate the mortgage market with ease.

Engaged in the Community: We’re always in tune with the latest trends and issues in rural communities. Our advice is relevant and impactful, helping you make the best decisions for your future.

Good Old-Fashioned Advice: We’re offering free consultations at Fieldays for rural professionals on salary or wages who are looking to buy their first home. Whether you work for an agri-business company, or on a farm in a salaried position, we’ve got you covered.