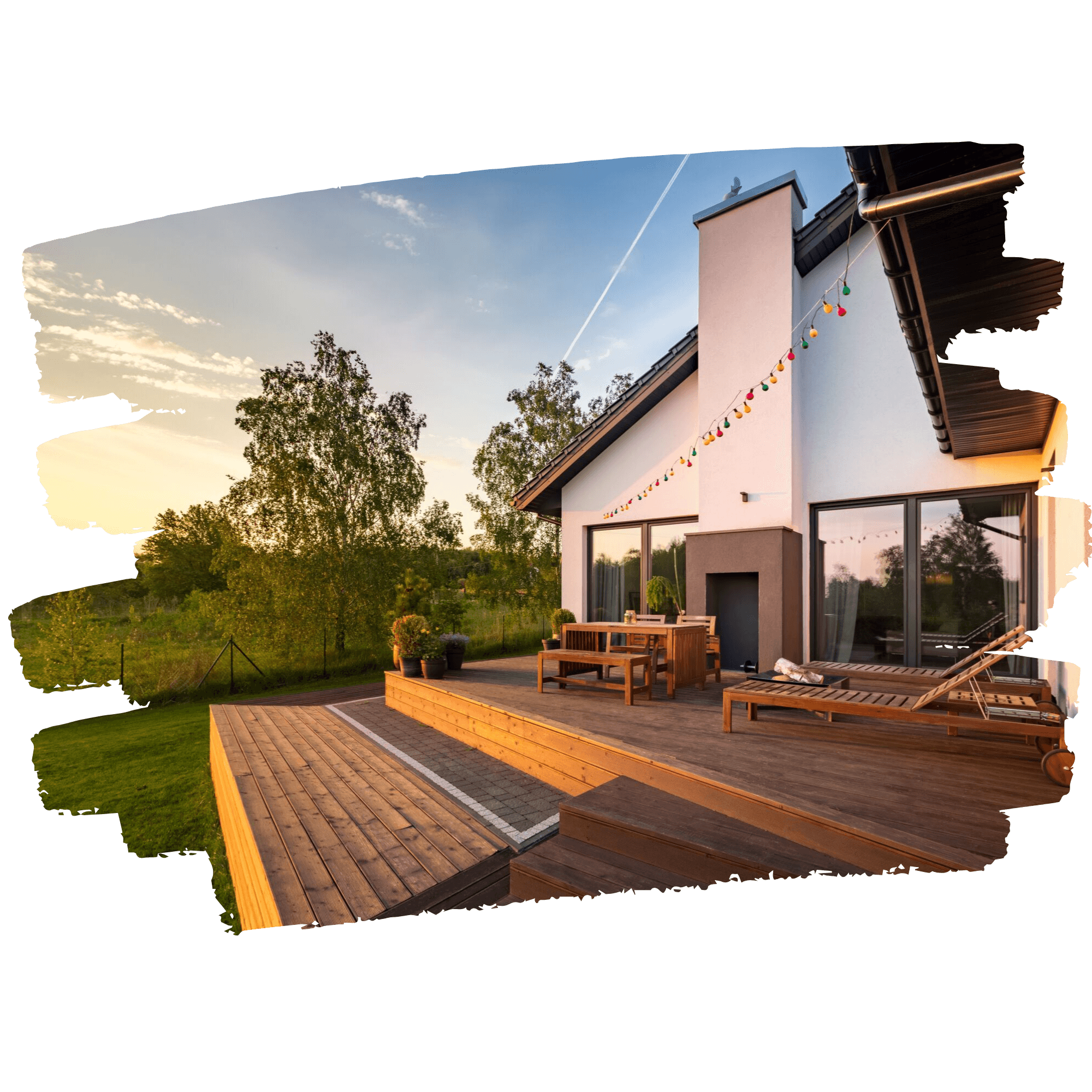

Sell your property &buy again with ease

Buying your dream home, upsizing, down sizing, moving location

Whatever the reason, My Mortgage can help you do it with ease. It's not something you do everyday and so when it comes time to do it, you need help from experts. There is a lot to consider, least of which is how much you can spend on your new property. It might be best to speak to My Mortgage even before you start the sales process so that you can make sure you can do what you are wanting to do in the time frame you want to do it in. Our advice is always free.

Contact the team about your selling & buying plans

We love hearing about your plans and goals for your properties so get in touch and let's talk about what are wanting to do and how you can get there.

From the Blog - Sell & Buy properties with ease

Book a time with an expert

For My Mortgage, home loans are all about people and stories, not numbers and dollars. By booking a time to speak with one of our expert team, we can give you free advice, guidance & what we think will be right for you as well as explain our mortgage repayment calculators. We can connect in person, via phone, online or email.

Whatever works best for you.